GREG Monthly Market Report

October 2023

“Typically the fall market starts to pick up momentum in September,” AIR president Chelsea Mann said in a press release. “However, sales activity for the month suggests that the weight of high interest rates continues to bog down both buyers and sellers. Many buyers and sellers have seemingly hit the brakes on their real estate efforts and have taken a wait-and-see approach, hoping for the cost of borrowing to lighten.”

“The market slowdown does not however mean that there aren’t still deals being made. Homes that are priced appropriately to reflect current market conditions are still being sold at an even pace.”

– Quote taken from Castanet article October 5, 2023

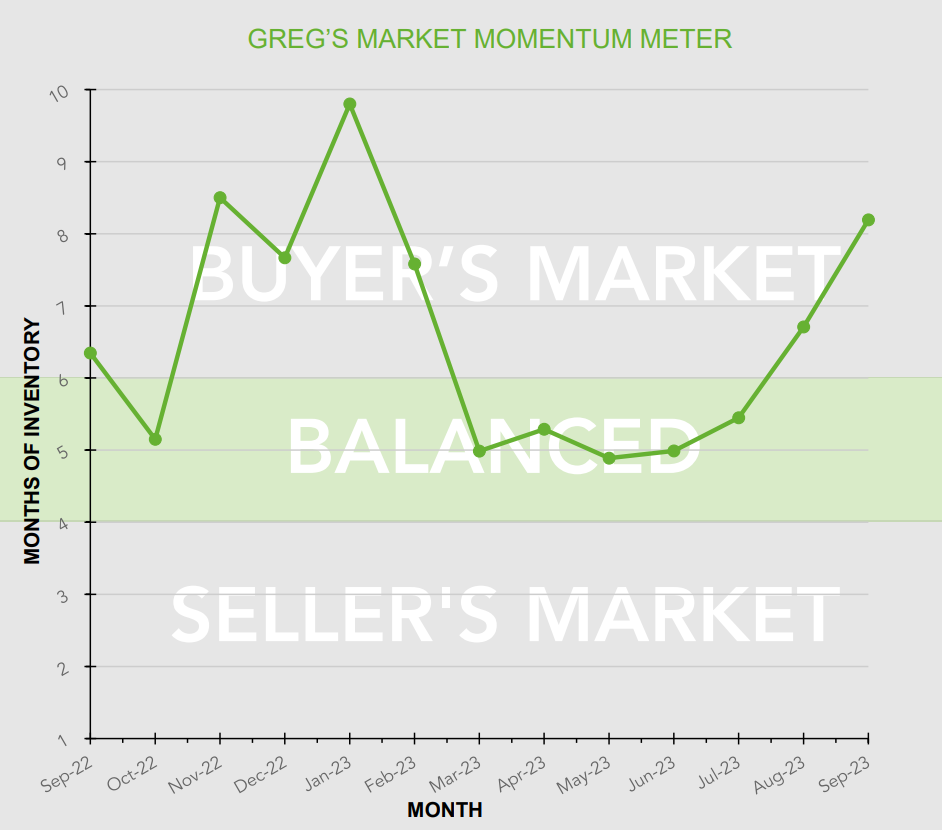

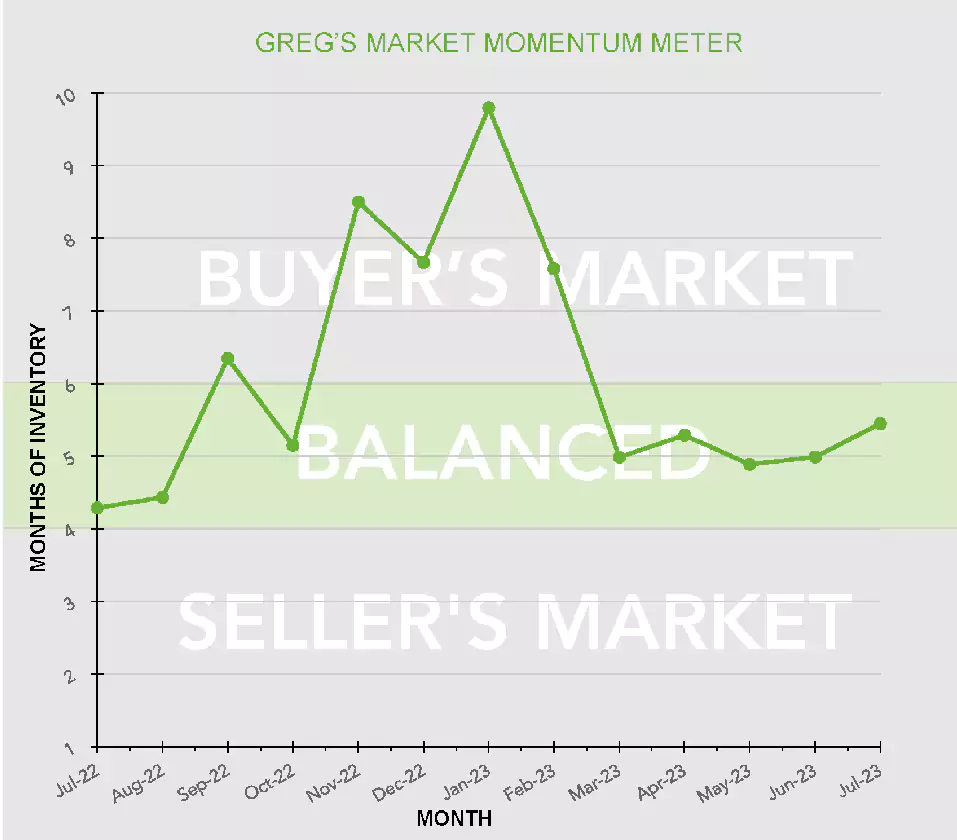

September 2023

In the South Okanagan, August has a history of being a slower month for real estate. When we look at the numbers, we see that this August is quite similar to the same time last year in terms of the number of homes sold. However, there’s a significant difference in the number of homes available for sale. We currently have 139 more homes listed for sale compared to last year.

This increase in the number of homes available for purchase, combined with the number of sales, has shifted the meter into the Buyers market zone.

Looking ahead to September, we anticipate a substantial increase in the number of new listings. This means that we could have the highest inventory of homes available for sale since November of 2020.

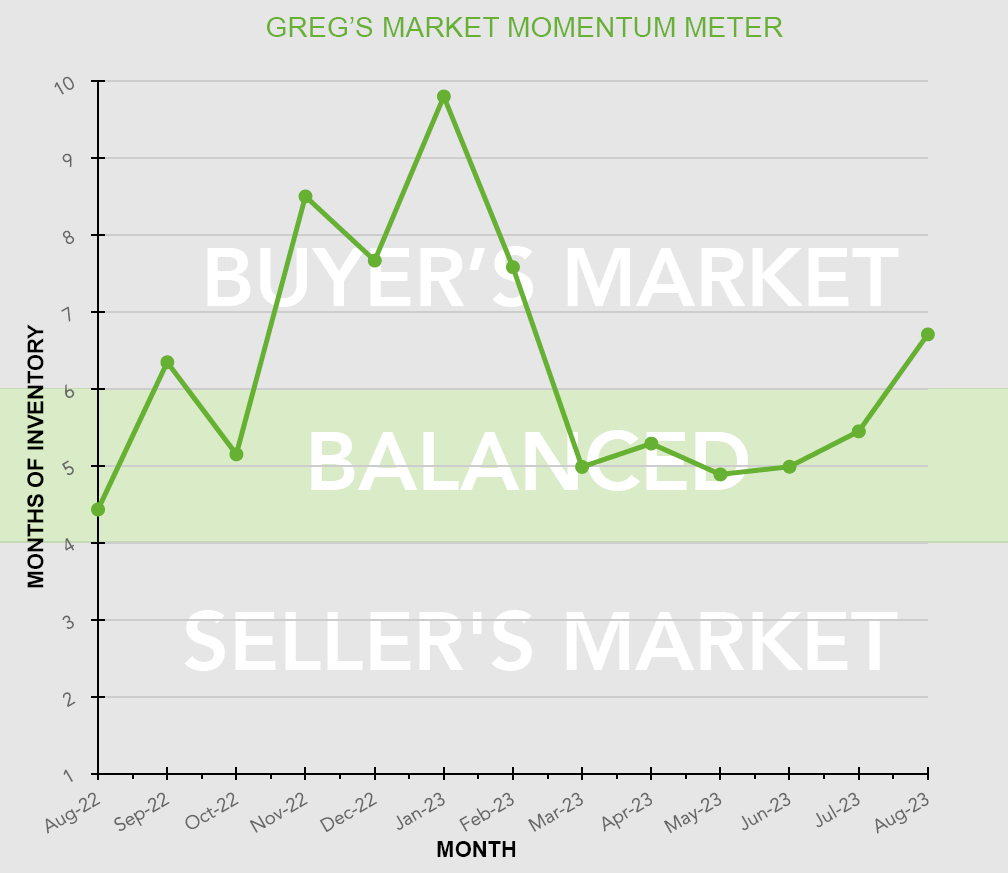

August 2023

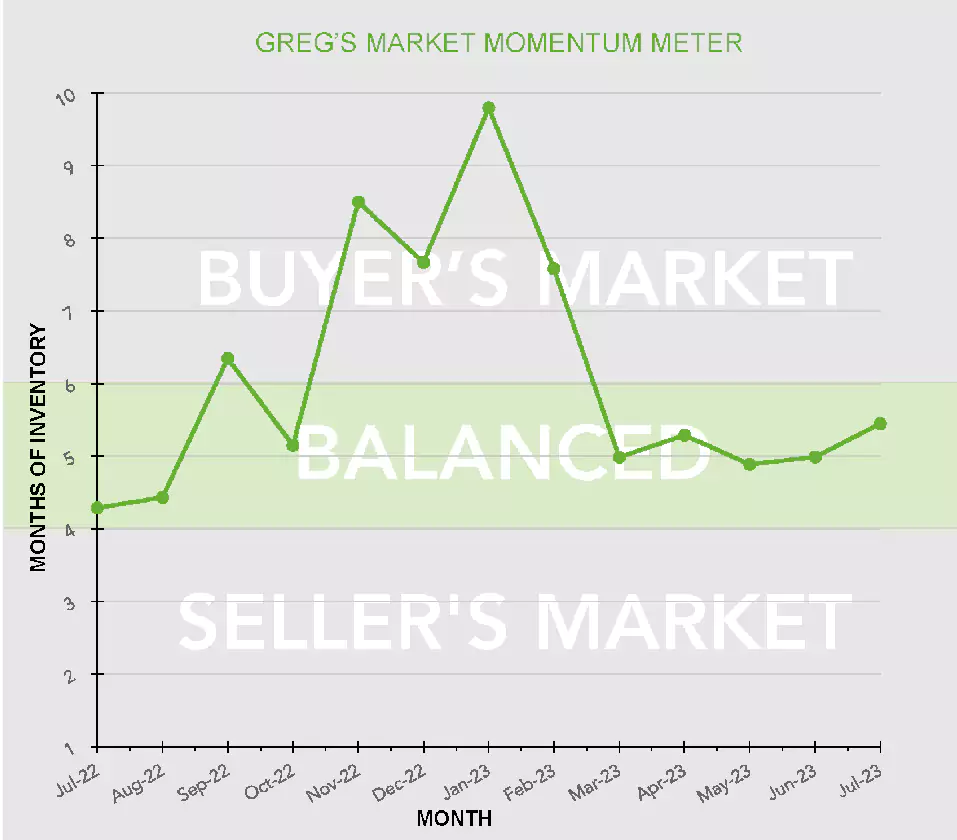

July 2023

Our Market Momentum Meter now indicates a consistent trend, revealing a balanced market in the South Okanagan with equal opportunities for buyers and sellers. This comes as a relief after experiencing unpredictable market shifts and a persistent shortage of available properties. Despite the limited inventory, the current market conditions provide a fair playing field for individuals interested in buying or selling their homes.

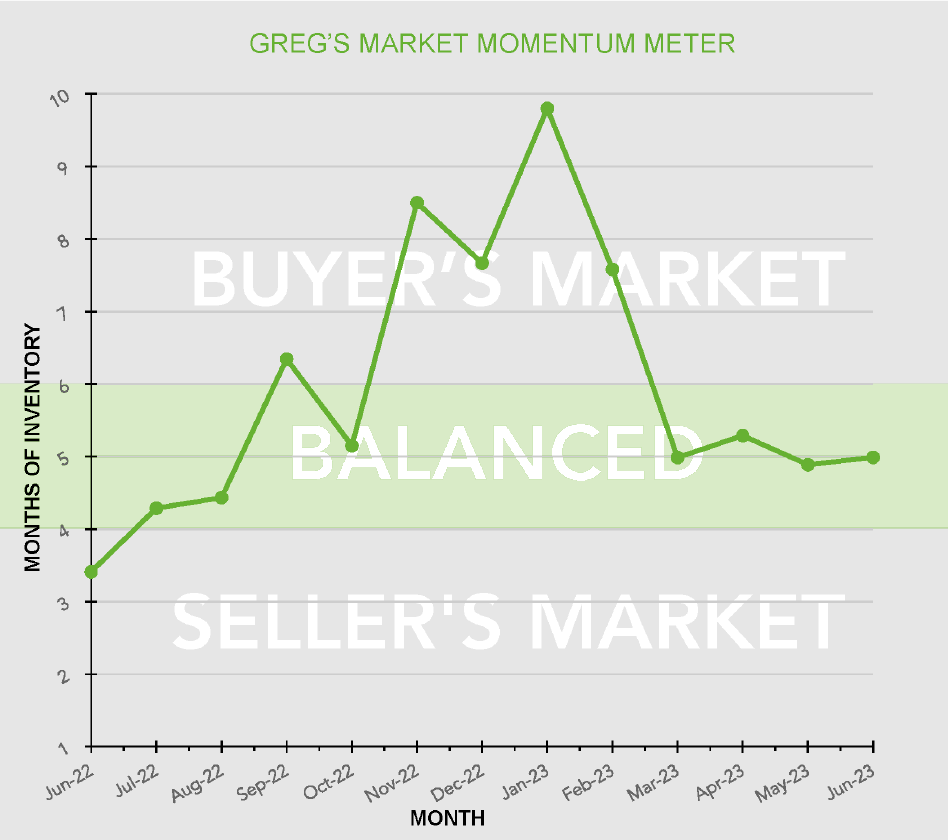

June 2023

As anticipated, spring has brought an increase in activity, resulting in the highest inventory levels since 2019. The market remains balanced with a healthy number of sales. However, our team has faced challenges in predicting sales prices due to the wide range and inconsistency in the market. This can be attributed to the limited availability of desirable properties, leading buyers with time constraints to pay a premium. Some well-priced homes are lingering on the market without motivated buyers. Furthermore, individuals relocating from larger cities continue to receive top dollar for their properties and exhibit less price sensitivity when purchasing in the Okanagan region.

May 2023

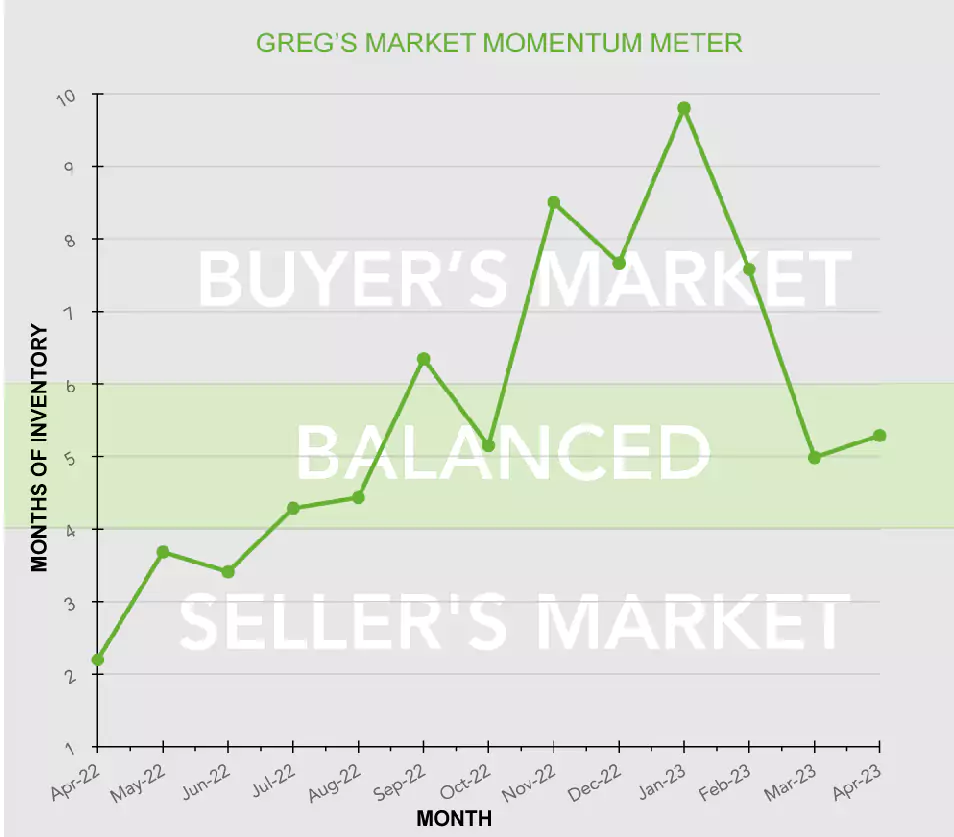

April 2023

Our Market Momentum Meter shows that we are currently in a balanced position. It’s great to see indications of a strong spring market for our clients.

After a tumultuous and speculative period in real estate we are now seeing an increase in sales with a moderate supply of inventory on the market, giving our clients more opportunity for buying and selling.

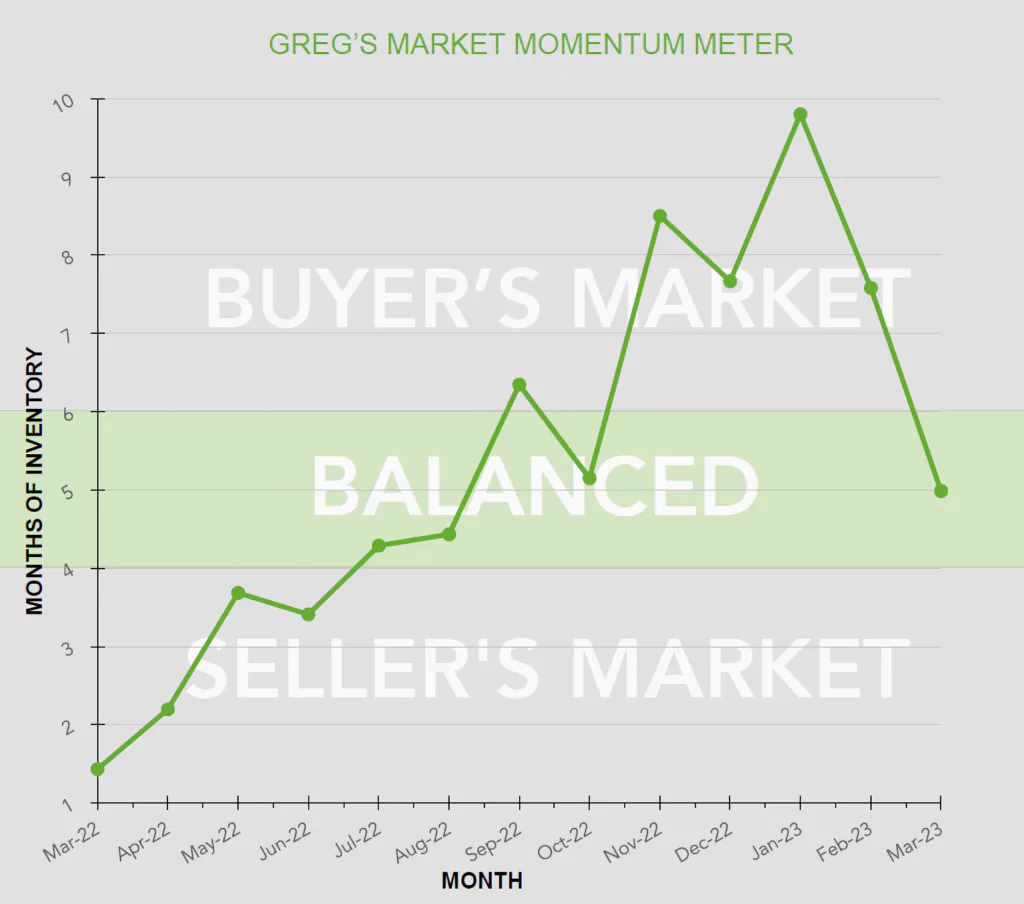

March 2023

Our Market Momentum Meter indicates that Buyers should be calling the shots now. But interestingly, our clients, colleagues, and our team doesn’t see it this way yet. Most Buyers feel the current inventory lacks in quality and is not presenting a wide selection of properties to choose from.

In most cases, Sellers have not accepted that the value of their property based on early 2022 data is not the value of their property now. However, we have successfully found properties at fair adjusted prices based on a high level of market research, and presenting offers accompanied by our market evaluations.

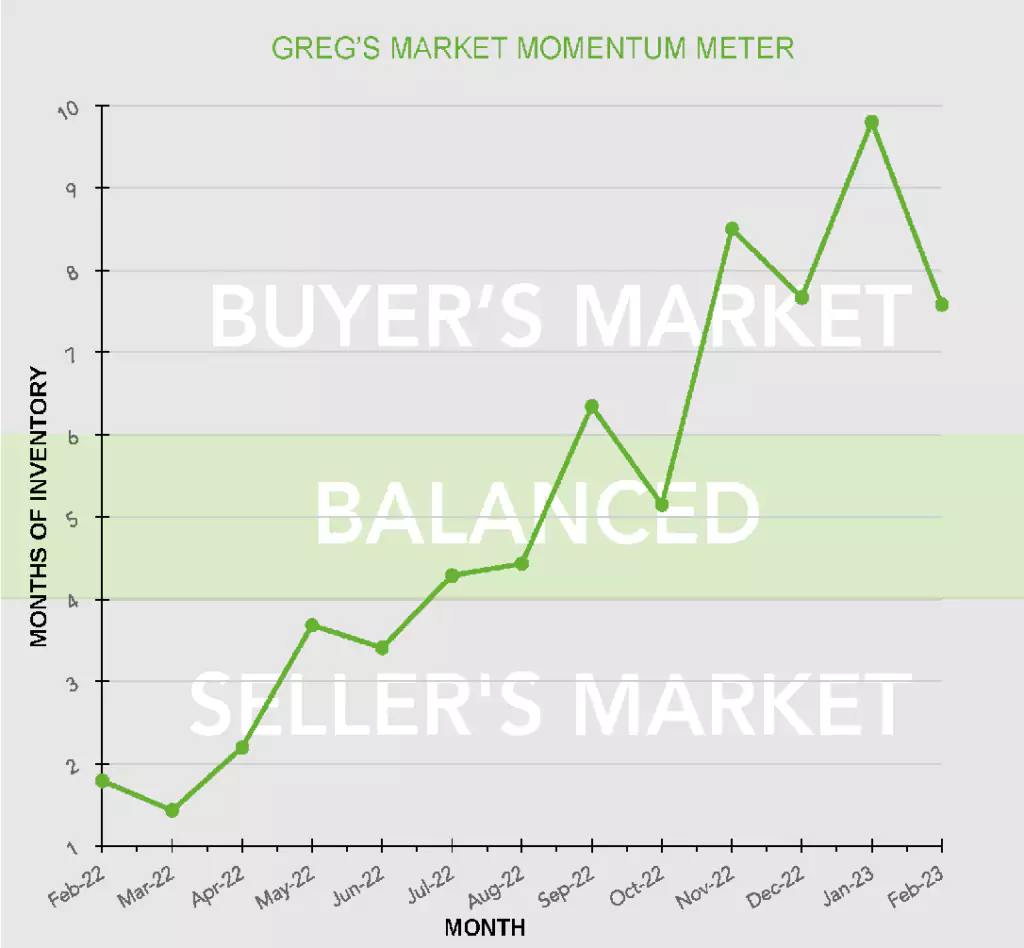

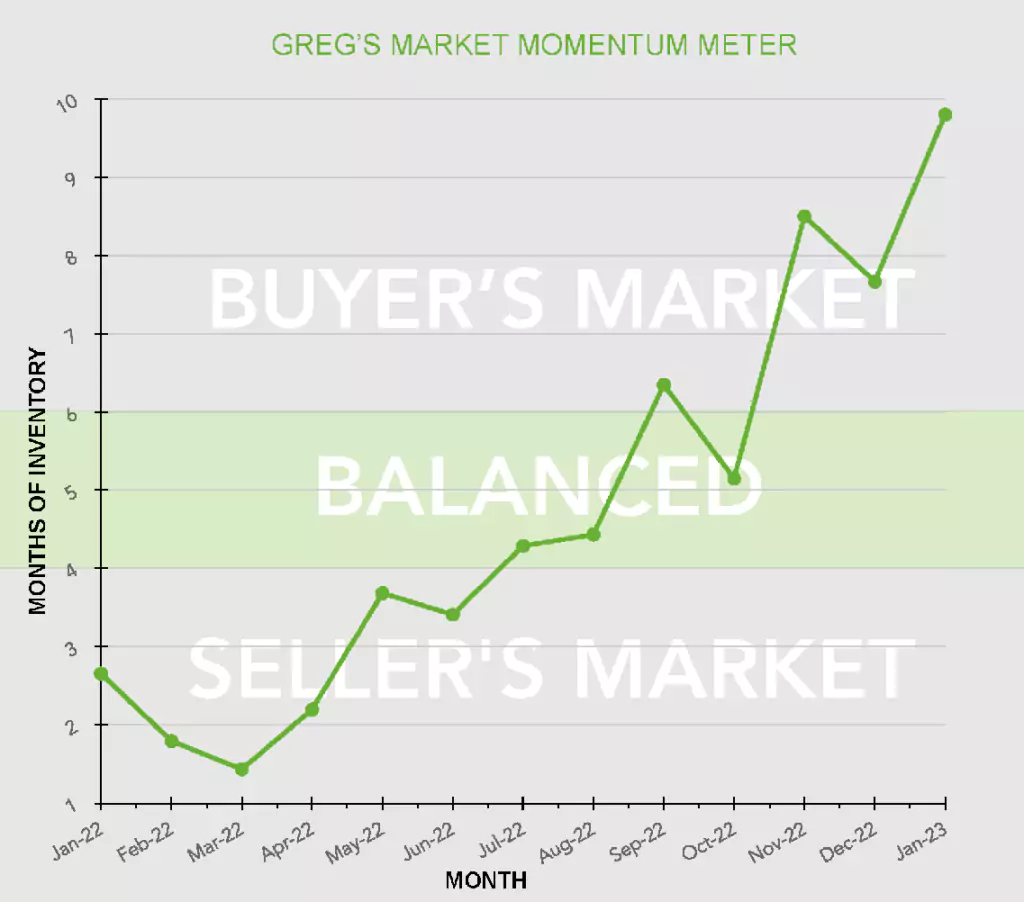

February 2023

The latest market data shows that we are in a strong Buyers market. But, some Buyers might be thinking, “Wait a minute, why doesn’t it feel like it?” Let’s explore a few factors that are playing a role:

Inventory levels are rising, but they’re still not at historical levels. With limited supply, it’s not uncommon for prices to stay higher.

The Bank of Canada has raised interest rates eight times. This has put a lot of Buyers in a holding pattern which is the major contributor to the lack of sales.

- Many Sellers have not adjusted their price expectations. This has lead to the misalignment of Buyers and Sellers expectations of value.

In conclusion, the extreme spike into a Buyers market is not due to rising inventory levels but the fact that there have been substantially less monthly sales.

January 2023

December and January are the least accurate months for the momentum meter as they do not typically reflect the true state of the real estate market. During the Holiday season, many Sellers take their properties off the market and Buyers tend to be less active.

Inventory decreases dramatically for a short time and Buyers focus on Christmas. Most of the unsold properties will be back on the market throughout January and early spring. At that time the momentum meter should definitively show the type of market 2023 will be.

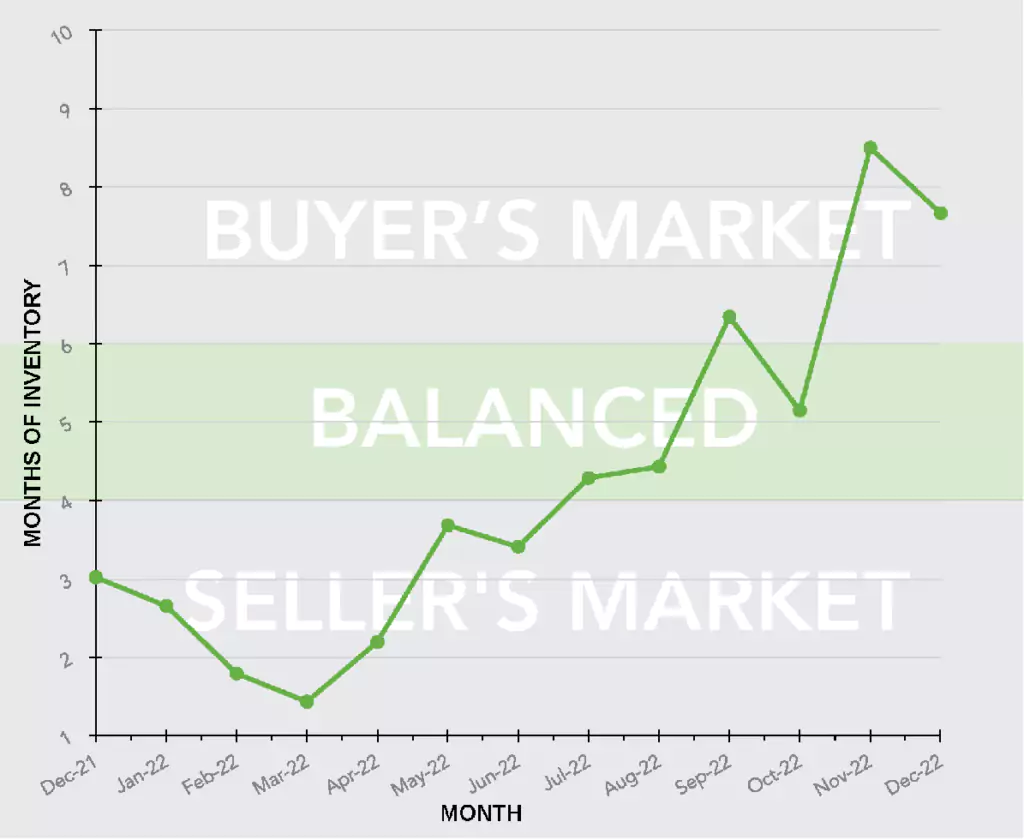

December 2022

“Why do we have a dotted line in this month’s graph?” We wanted to note that Skaha Lake Tower Development released 70 units for sale last month which created an extraordinary increase in inventory resulting in a large jump into a Buyer’s market.

The dotted line shows where we would be without this increase, which is a more reasonable representation of where we are at. While we are indeed experiencing a Buyer’s Market it is not as extreme as the graph shows this month.

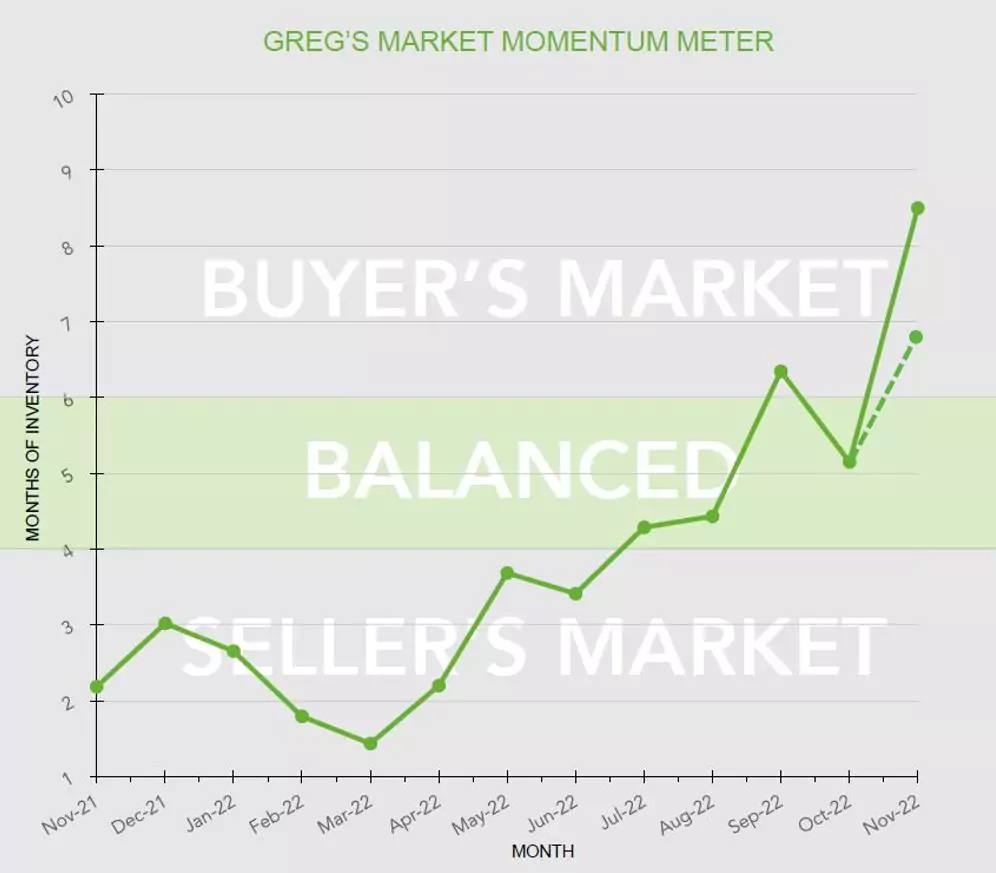

November 2022

The Number of properties sold was up 12% over last month with inventory virtually the same. This has moved the meter back down into a balanced market. However, you can see that within the drastic momentum change since March there has been a few months where the momentum shifted but then continued back on trend.

With another interest rate hike and many Buyers and Sellers on the sideline we feel that we will continue to stay between a balanced market and a Buyers market for the next several months especially if inventory stays low.

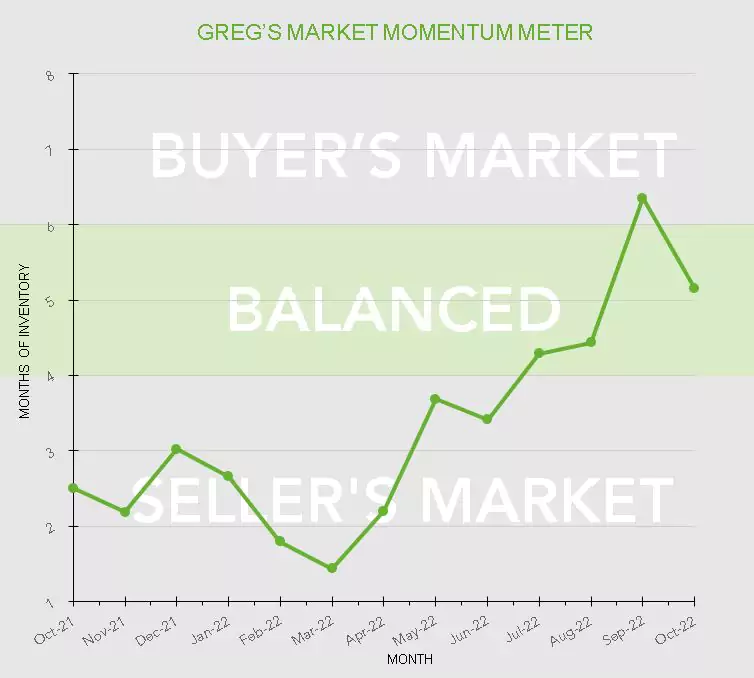

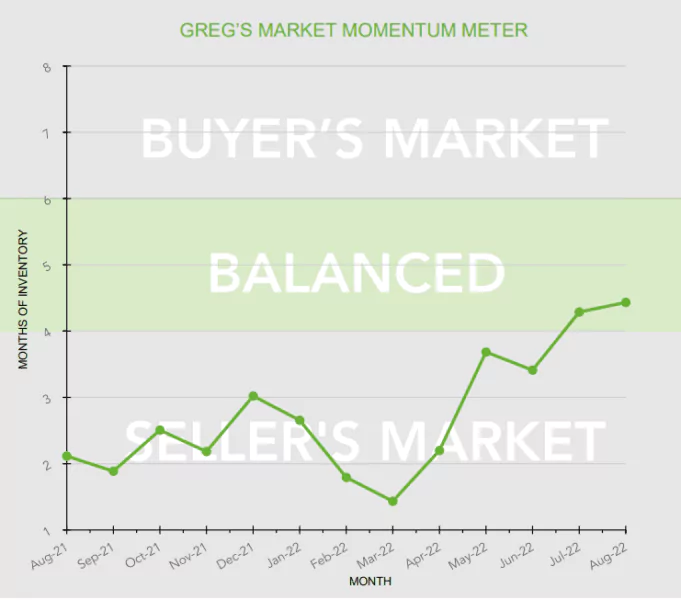

October 2022

This month’s momentum meter shows a surprising touch into a buyers market. While one month does not constitute a trend, we are eager to see market activity pick back up for the remainder of 2022.

Sales were way down, interest rates held back many buyers from entering the market, and the change from Summer vacation to Fall and school could have been a factor in this slow down. As interest rates continue to increase into 2023 we feel that the market will continue to trend in a balanced position overall.

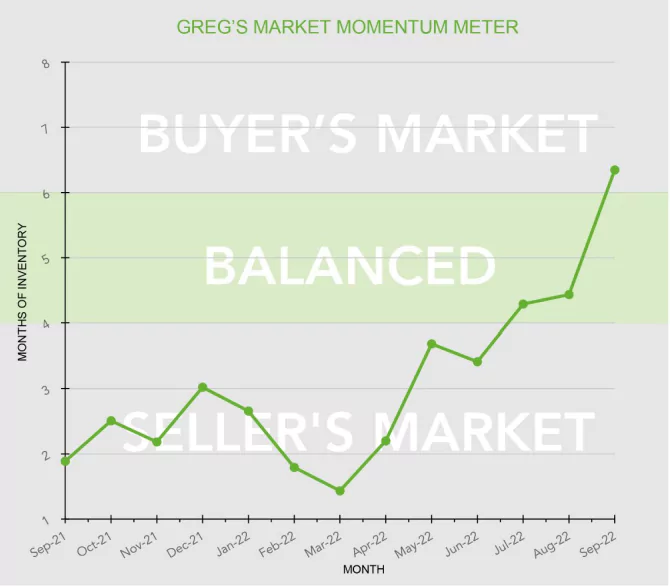

September 2022

This month’s momentum meter shows a dramatic swing from a balanced market to a buyer’s market. While one month does not constitute a trend, it will be interesting to see next months stats as the previous 3 months have been moving in the same direction.

Sales were way down from 67 units in August to 49 units in September while inventory rose from 297 to 311. Increased interest rates, market uncertainty, inflation, and the change from Summer vacation to Fall and school where major factors in the month of September.